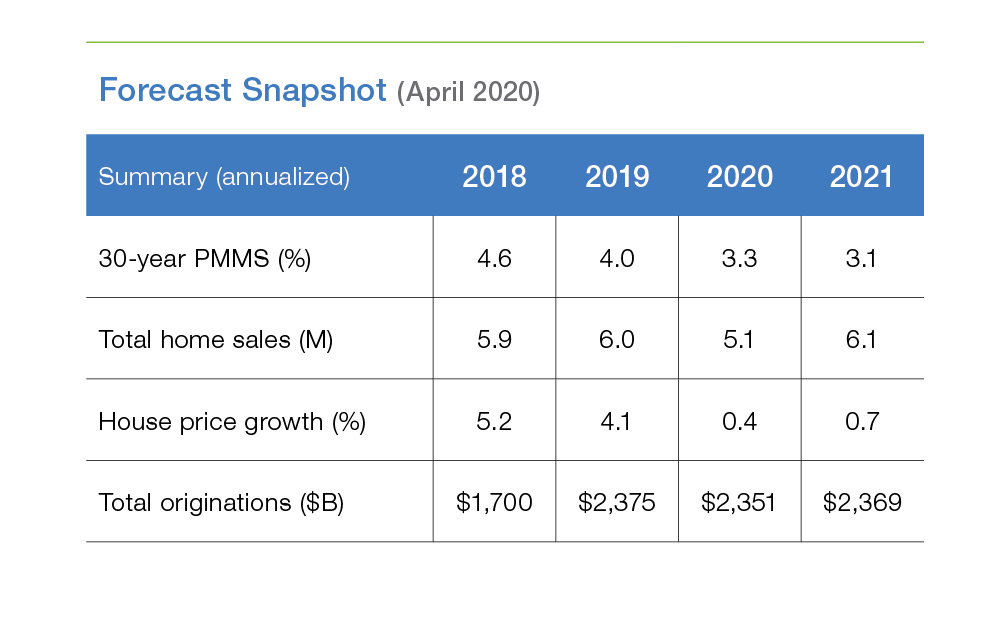

There is a light at the end of the shutdown tunnel! According to Freddie Mac on April 9, 2020, “while mortgage rates remained flat over the last week, there is room for rates to move down. This year the 10-year Treasury market has declined by over a full percentage point, yet mortgage rates have only declined by one-third of a point. As financial markets continue to heal, we expect mortgage rates will drift lower in the second half of 2020.”

There is a light at the end of the shutdown tunnel! According to Freddie Mac on April 9, 2020, “while mortgage rates remained flat over the last week, there is room for rates to move down. This year the 10-year Treasury market has declined by over a full percentage point, yet mortgage rates have only declined by one-third of a point. As financial markets continue to heal, we expect mortgage rates will drift lower in the second half of 2020.”

Their forecast for 2021 is very encouraging, predicting a slight bump in volume and sale price, despite the economic downturn we are facing.

There are a few caveats for certain types of loans, however. O’Dette Mortgage Group in Tahoe City says that:

There are a few caveats for certain types of loans, however. O’Dette Mortgage Group in Tahoe City says that:

- Lenders have tightened credit standards for Jumbo loans in reaction to the economic impact of the Coronavirus Pandemic. Contrary to what’s happening in the Conforming mortgage market (Fannie Mae and Freddie Mac), at the time of this writing lenders have increased rates on Jumbo loans. This will likely cause a drag on the High-End market as buyers may not qualify for the necessary loan amount to meet a seller’s asking price, if they qualify at all.

- The secondary market is in turmoil. Investors for alternative loans known as “Non-QM” mortgages have lost all appetite and consequently, similar to the post-2008 crash, borrowers with unique finances and special considerations who do not “fit the box” may have difficulty obtaining a mortgage, especially at higher price points.

- Buyers, sellers and agents should plan on longer than usual contract periods as lenders are backed up with refinances, the IRS has been slow to respond to verification requests, and appraisals are being held up due to the Coronavirus.

- We expect these challenges to ease over time as the pandemic subsides, government interventions kick in, and markets adapt and eventually recover as they always do. Rates will likely remain historically low for the foreseeable future providing buyers with significant incentives, and new underwriting rules should gradually loosen as risk factors diminish and investors get more comfortable with the recovery.

- O’Dette Mortgage Group is currently prioritizing purchase mortgages over refinances. We are closing purchases in as little as 30 days to allow buyers to make more competitive offers than those obtaining financing from other lenders. Contact Teresa O’Dette to discuss the market overall or your particular circumstances at 530-581-5089 or contact online here.